Navigating the stock market is thrilling, but understanding the tax implications of your gains is crucial. Recent updates in India’s tax regime have brought significant changes to how capital gains are taxed. Let’s break down the essentials.

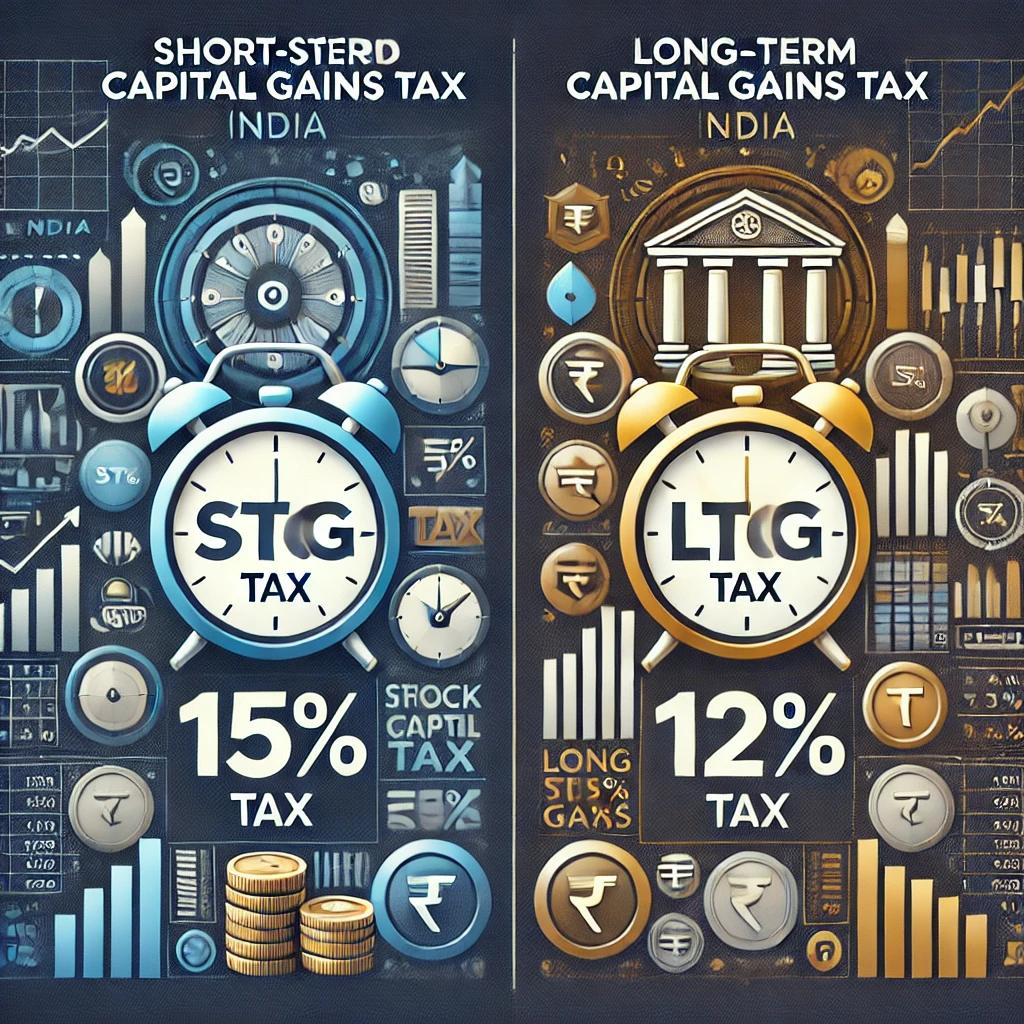

1️⃣ Short-Term Capital Gains Tax (STCG)

-

Definition: Gains from selling assets held for 12 months or less.

-

Tax Rate: 15% (plus applicable surcharge and cess).

-

Applicability: Applies to profits from stocks, mutual funds, and other capital assets.

2️⃣ Long-Term Capital Gains Tax (LTCG)

-

Definition: Gains from selling assets held for more than 12 months.

-

Tax Rate: 12.5% on gains exceeding ₹1.25 lakh, without indexation benefits.

-

Recent Changes: The Union Budget 2024-25 increased the LTCG tax rate from 10% to 12.5% and removed the indexation benefit that previously allowed investors to adjust the purchase price of assets for inflation.

📊 Tax-Saving Strategies for Traders

✔ Tax Harvesting: Strategically book profits within the ₹1.25 lakh exemption limit to minimize tax liability.

✔ Offset Gains with Losses: Use capital losses to offset gains, reducing taxable income.

✔ Invest in Tax-Efficient Instruments: Consider options like Equity-Linked Savings Schemes (ELSS) or Unit-Linked Insurance Plans (ULIPs) for potential tax benefits.

💡 Stay Ahead in the Market! Master operator trading strategies with Market Mantraa Trading Academy. Equip yourself with the knowledge to navigate these tax changes effectively.

Join our masterclass now! 📈 #MarketMantraa #StockMarketIndia #TradingTips #STCG #LTCG #TaxPlanning #InvestmentStrategies #